2026 Mass Save Rebates Reduced Under Stricter Guidelines | Rebates & Tax Credits | Mendon, MA

Mass Save® rebates in Mendon have been reduced for 2026, with stricter qualification rules and up to $1,500 less in incentives compared to 2025. To secure the highest available rebate—before amounts decrease further—homeowners should act quickly while funding remains.

Heat Pump Upgrades in Mendon, MA: Smarter Moves Amid Stricter 2026 Mass Save® Rules

If you're a homeowner in Mendon, MA, you're probably already thinking about how to make your home more energy-efficient to handle New England’s unpredictable seasons. Cold winters, humid summers, and rising energy costs make heating and cooling systems a priority here. Among the options, heat pumps are still the top choice for efficient, year-round home comfort. But with 2026 bringing lower rebates and tighter rules under the Mass Save® program, understanding your timing and eligibility is critical.

Residents of Mendon who have been thinking of upgrading their HVAC systems face a clear message: if you're looking to take advantage of state-backed savings, now is the time.

"Massachusetts is shifting toward greater efficiency and environmental responsibility. That means better systems win better savings—but only if you act before the rules change again."

Let’s dive deep into how the 2026 Mass Save® rebates apply to homes in Mendon and why it’s so important to take action while more generous incentives are still available.

2026 Mass Save® Rebates: What’s Changing and Why it Matters

Starting in 2026, the Mass Save® program has significantly reduced heat pump rebate values from previous years and introduced stricter efficiency and refrigerant requirements. This means accessing the full value of available incentives will be more competitive and depend on quick, informed decisions.

Reduced Rebate Amounts for Mendon Homeowners

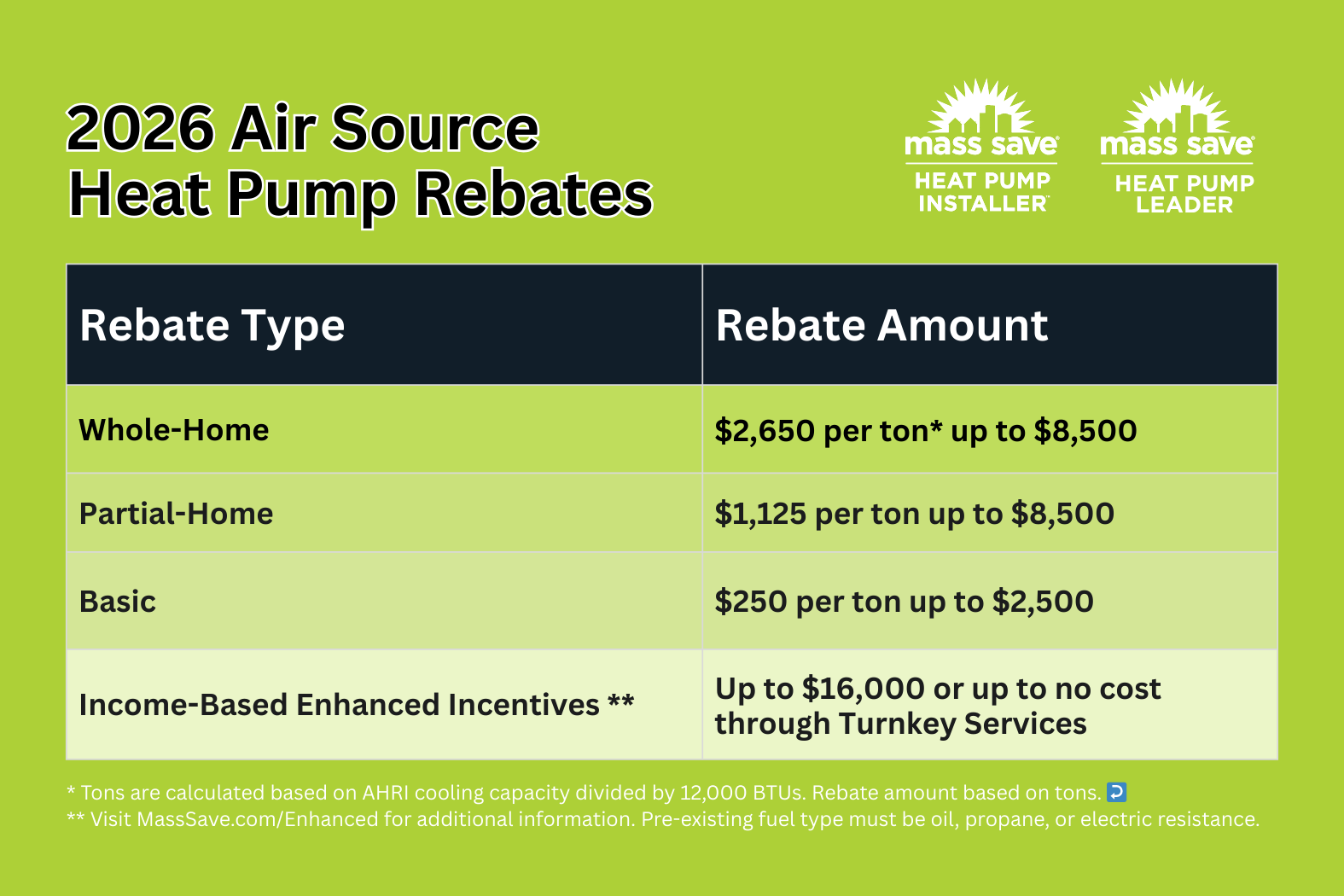

In 2025, homeowners could access up to $10,000 in rebates. But as of 2026, the rebate ceiling has dropped to $8,500. Here’s a breakdown of key rebate types:

- Whole-Home Installations: $2,650 per ton, up to $8,500

- Partial-Home Upgrades: $1,125 per ton, up to $8,500

- Basic Heat Pump Installation: $250 per ton, up to $2,500

- Income-Based Enhanced Incentives: Up to $16,000 or near-total cost coverage through Turnkey Services

This drop makes early action essential. The longer you wait, the more stringent the conditions become—and the less money you stand to receive.

"In 2026, Mendon homeowners will see as much as $1,500 less in Mass Save® rebates compared to 2025. That could be the difference between a comprehensive upgrade and settling for less."

New Efficiency and Refrigerant Requirements

In addition to shrinking financial incentives, eligibility now hinges on using approved refrigerants and meeting system efficiency standards:

- Units installed must use low-GWP (Global Warming Potential) refrigerants. Legacy systems using R-410A are no longer eligible.

- The system must meet approved energy performance benchmarks set by Mass Save® guidelines.

For Mendon, full-home electrification using the latest heat pump models ensures year-round comfort with the least environmental impact—while still qualifying for top rebates.

Why Heat Pumps Still Make Sense for Mendon Homes

While the rebate numbers shrink, heat pumps remain a leading choice for Massachusetts homeowners wanting to lower costs and carbon footprints. The technology continues to deliver exceptional value, especially in Mendon where energy use spikes in both summer and winter seasons.

Year-Round Comfort with One System

Mendon’s climate sees wide seasonal variation—from sub-zero winter nights to humid, 90-degree summer days. That’s where heat pumps shine:

- Efficient heating in winter, even as temperatures drop

- Effective cooling in hot, muggy conditions

- Consistent indoor air quality year-round

Today’s high-performance heat pumps are built for New England, and whole-home systems can replace aging oil, propane, or electric baseboard setups.

Long-Term Savings, Even as Incentives Decline

While upfront rebates are declining, homeowners still stand to save thousands in energy costs over time:

- Low operating costs compared to fossil fuels

- Integrated indoor air control and zoning

- Reduced maintenance and increased lifespan compared to traditional HVAC

Energy-efficient upgrades pay for themselves in Mendon, where utility costs can be high and heating demands are significant for much of the year.

Changes That Impact Eligibility in 2026

For those still planning their upgrade, it's important to understand what may now disqualify a system under the new Mass Save® rebate rules.

Outdated Refrigerants Disqualify Systems

The industry is moving away from R-410A refrigerants due to high climate impact. In 2026, Mass Save® rebates require qualifying systems to use a low-GWP refrigerant, such as R-454B or R-32.

Systems using R-410A—even if brand new—will not qualify for any rebate. If you’ve been putting off the upgrade, make sure your system options meet the current refrigerant requirements published by Mass Save®.

Efficiency Ratings and Installation Details Matter

Along with refrigerant compliance:

- System efficiency must meet specific Seasonal Energy Efficiency Ratios (SEER2) and Heating Seasonal Performance Factors (HSPF2)

- Systems must be installed by a licensed contractor participating in the Mass Save® Heat Pump Installer Network

Partial upgrades (adding a single unit or integrating a heat pump with existing oil or gas systems) can qualify for reduced rebates, but only under an approved installation path.

To view details and requirements, refer to the official Mass Save® heat pump page: Mass Save® Heat Pump Rebates

Income-Based Incentives Still Provide Robust Support

Even though base rebate tiers have dropped, enhanced support remains for income-qualified households in Mendon.

Income-Based Rebates Worth Up to $16,000

The Mass Save® Income-Eligible Enhanced Electrification Initiative provides:

- Up to $16,000 in heat pump rebates

- No- or low-cost installation through Turnkey Services

- Additional incentives on insulation, weatherization, and energy assessments

Homeowners should apply through the Mass Save® portal to verify income qualifications. These income-based programs continue to offer strong support, especially for families transitioning from high-cost fuels like oil or propane.

Free Home Energy Assessments Available

Residents of Mendon can still access no-cost Home Energy Assessments to determine upgrade options and rebate eligibility. These evaluations lay the groundwork for smart energy decisions, including verification of weatherization needs to maximize heat pump performance.

Why Timing Is Everything in 2026

One of the clearest takeaways for Mendon homeowners in 2026 is this: the longer you wait, the fewer incentives are likely to remain.

Rebates Decline Year After Year

The current trend within Mass Save® is clear—rebates are shrinking, not growing. In 2024, some homeowners accessed $10,000+ incentives. Now, top amounts have fallen to $8,500.

There is no indication that these figures will increase again. Holding off could mean losing thousands in funding for a project you plan to do eventually.

Federal Tax Credits Have Ended

Adding further urgency to timing, federal tax credits for heat pump installations have been phased out as of 2024. That removes a second potential layer of savings. With Mass Save® remaining as the final financial support channel, locking in available state rebates should be top priority.

Heating Electrification Under Utility Rate Programs

Mendon homeowners can still benefit from utility-specific winter electric rate reduction programs.

Lower Winter Heating Costs with Rate Plans

Utility companies like National Grid and Eversource offer:

- Time-of-use rate plans designed for heat pump users

- Discounted winter electricity rates for whole-home electrification

- Additional support for households upgrading from oil or propane

Heat pumps installed with smart controls and enhanced HVAC zoning can tie into these rate plans—pairing operational efficiency with utility discounts when used during peak winter months.

Integration with Weatherization Services

To capture the full benefit of these utility and rebate programs, homeowners in Mendon are encouraged to:

- Improve insulation and air sealing

- Upgrade windows and shell components

- Replace fossil fuel heating with all-electric HVAC

These measures not only ensure maximum efficiency but are often required prerequisites to access larger incentive tiers.

“Whether you’re retrofitting a 1980s Mendon colonial or a more modern build, weatherization is step one. It’s also where Mass Save® enhanced services begin making a difference.”

Summary: What Mendon Homeowners Need to Know in 2026

While Massachusetts continues to promote home electrification through incentives, the 2026 Mass Save® updates mean Mendon residents face new limitations, lower rebates, and stricter system requirements. However, the opportunity for transformational energy savings is still strong—especially for those ready to act now.

Key takeaways for Mendon-based homeowners:

- Rebate limits have dropped to $8,500, down from $10,000 in prior years

- Partial and basic installations qualify, but benefit less

- R-410A systems no longer qualify for any rebates

- Only low-GWP refrigerant systems are approved

- Income-qualified residents can receive up to $16,000 in support

- Federal tax credits are no longer in place

- Timing is vital: available incentives will continue to decrease

While the path to rebates is now more complex, Mendon homeowners who plan smartly and act early can still capture substantial rewards. Heat pumps remain one of the most supported energy upgrades across Massachusetts—and they continue to deliver real comfort, savings, and sustainability for the long term.

What Local Homeowners Are Saying

See how SumZero has helped local homeowners stay comfortable year-round with energy-efficient heat pump solutions.

Not Sure Where to Start? We’ll Guide You

Let our experts design the right heating and cooling solution—customized for your comfort, your layout, and your energy goals. No pressure. Just clarity.

Request FREE ESTIMATE