2026 Mass Save Heat Pump Rebate Changes and Rules | Rebates & Tax Credits | Concord, MA

The 2026 Mass Save® heat pump rebates offer significant savings for Concord homeowners upgrading to high-efficiency heating and cooling systems, but recent changes have reduced rebate amounts and tightened qualification rules. With federal tax credits now unavailable and whole-home incentives dropping from $10,000 to $8,500, securing your rebate early is essential to maximize savings before further reductions take effect.

2026 Mass Save Heat Pump Rebate Changes and Rules

Homeowners in Concord, MA are no strangers to New England’s unpredictable climate—frigid winters, humid summers, and everything in between. Staying comfortable year-round while keeping energy bills low is more important than ever for local residents. That’s where heat pumps come in, offering energy-efficient heating and cooling in one system. But before jumping into a heat pump upgrade, understanding the latest 2026 Mass Save® rebate program is crucial. This year brings big changes—lower amounts, stricter eligibility, and the end of federal tax credits. Knowing what's changed and what still qualifies could save Concord homeowners thousands of dollars if they act soon.

What’s Changed in the 2026 Mass Save® Heat Pump Rebates?

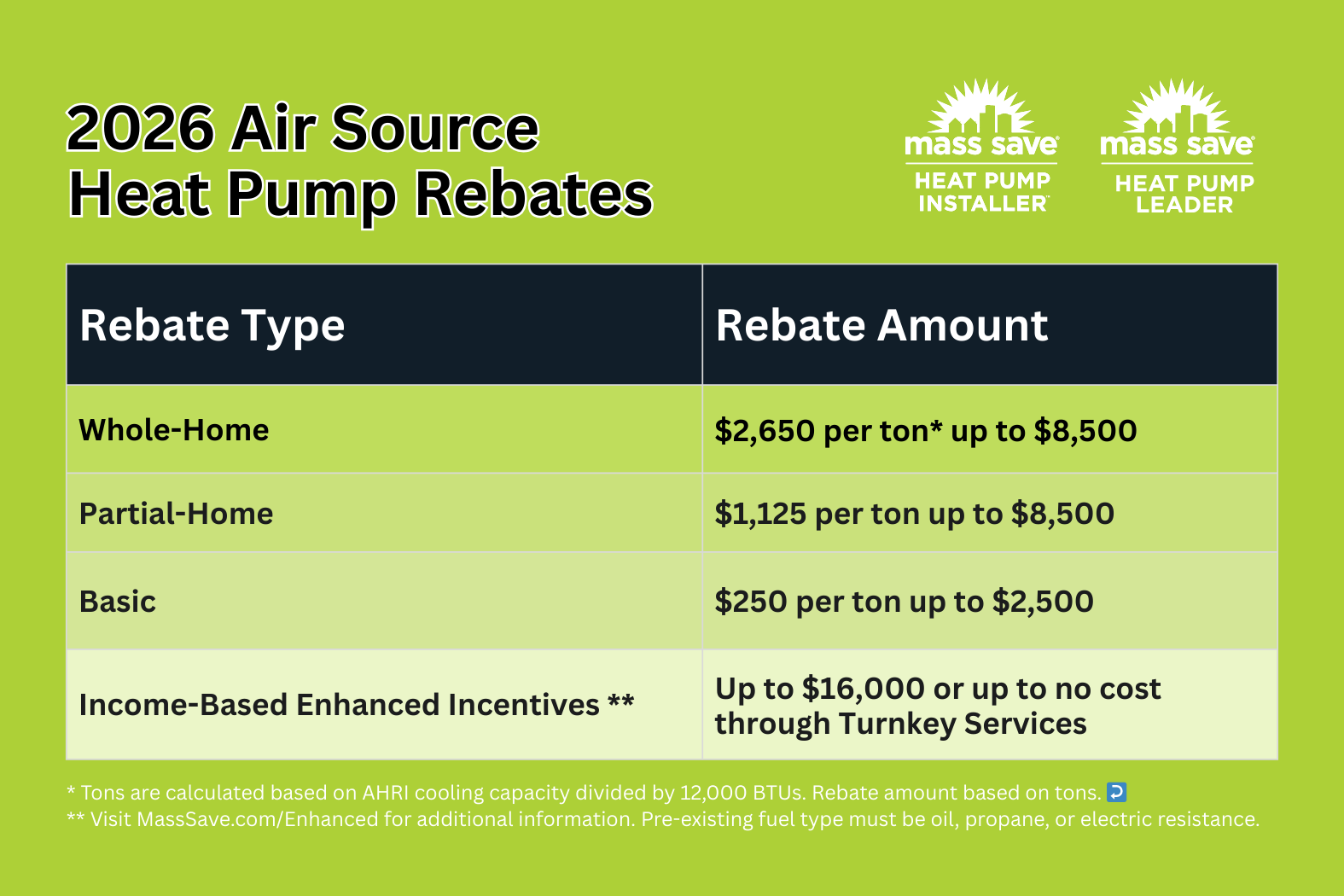

The Mass Save® program is still offering rebates in 2026—but with major changes compared to previous years. The rebate amounts have decreased, and new qualification requirements mean not all systems will be eligible.

Lower Rebate Amounts Than Previous Years

Compared to 2025, the 2026 rebates have dropped by $1,500 across the board for most tiers.

- Whole-Home Rebate: $2,650 per ton, up to a maximum of $8,500

- Partial-Home Rebate: $1,125 per ton, also up to $8,500

- Basic Rebate: $250 per ton, capped at $2,500

- Income-Based Enhanced Incentives: Up to $16,000—or in some cases—turnkey, no-cost systems for qualifying households

This reduction means homeowners in Concord considering heat pump upgrades will benefit from acting now rather than delaying further.

“In 2026, the longer homeowners wait, the less value they stand to gain. Rebates are decreasing over time—not increasing.”

For Concord residents dealing with high energy bills from oil, propane, or electric baseboard heat, investing in a heat pump sooner rather than later is crucial for capturing the highest rebate possible.

New System Requirements and Refrigerant Regulations

Mass Save® introduced an important new requirement: eligible heat pump systems must now use approved low-GWP (low global warming potential) refrigerants. Older systems that use the common refrigerant R-410A no longer qualify for 2026 rebates.

This change reflects Massachusetts' commitment to reducing greenhouse gas emissions, aligning with its energy goals for 2030 and beyond.

“If your system uses R-410A, it’s no longer eligible for a rebate—new installations must align with low-GWP standards to qualify.”

Homeowners should confirm with their contractor or installer that the proposed heat pump system complies with these new refrigerant requirements.

Types of Heat Pump Rebates Available in 2026

Choosing the right rebate path depends on how you plan to use the heat pump in your home. Mass Save® offers several categories to suit different property types and upgrade goals.

Whole-Home Rebates

Whole-home rebates are available for homeowners who switch fully to heat pump heating and cooling, eliminating fossil fuel dependency.

- Rebate: $2,650 per ton

- Maximum: $8,500

- Qualifications: Must heat at least 90% of the home's square footage with eligible heat pumps and decommission other heating sources

For many Concord homes—especially larger Colonials and Victorians popular in the area—this may require multiple indoor units or ducted systems.

Partial-Home Rebates

Partial-home rebates apply when a heat pump supplements, but doesn’t fully replace, an existing heating system.

- Rebate: $1,125 per ton

- Maximum: $8,500

- Best for: Homes where full electrification isn’t feasible yet or phased upgrades are underway

Some Concord homeowners may fall into this category by using heat pumps on upper floors while retaining oil or gas heating downstairs.

Enhanced Income-Based Rebates for Qualifying Residents

Mass Save® continues to offer enhanced heat pump rebates for income-eligible residents through programs like the Income Eligible Program or moderate-income offerings via the Sponsors’ Turnkey Services.

No-Cost or Deeply Discounted Systems

- Benefit: Up to $16,000 in rebates

- In some cases: Full heat pump system installation at no out-of-pocket cost

Eligibility is based on gross household income and family size. For many in Concord struggling with rising heating bills, these programs offer a chance to both update aging systems and significantly cut costs.

“Thanks to income-qualified programs, some Concord households can replace their entire HVAC system for little or no cost through the Direct Install approach.”

Turnkey Services Streamline the Process

The Turnkey Services provided by Mass Save® take care of everything, including energy assessments, contractor coordination, and installation. This streamlined process is ideal for homeowners who want guidance and full support without navigating the rebate application process alone.

To check income eligibility or learn more, visit Mass Save's official portal:

Mass Save® Air Source Heat Pumps

Why Timing Matters for Concord Homeowners

One of the most critical factors this year is timing. Waiting until late in the year—or even into 2027—could mean further rebate reductions or loss of eligibility as program rules continue to evolve.

Early Installation Locks in Higher Rebates

The 2026 program already reflects significant reductions from 2025. If past trends continue, the 2027 rebates could be even smaller or more restrictive. Acting early helps Concord homeowners preserve the current rebate levels and ensures compliance with refrigerant standards before they change again.

Federal Heat Pump Tax Credit No Longer Available

Another big change is the elimination of the federal heat pump tax credit. This credit previously offered up to $2,000 in additional savings—but it's no longer available in 2026.

This shift makes timing even more important. While local rebates remain, the combined state and federal savings from prior years are no longer an option.

“Mass Save air-source heat pump rebates are still generous in 2026, but they won’t last forever—and the federal incentives have already run out."

Heat pump incentives are designed to drive rapid electrification across Massachusetts, but support levels are now trending downward as the state meets adoption targets.

Benefits of Heat Pumps Still Outweigh the Change in Rebates

Despite the lower rebate amounts and federal tax credit sunset, heat pumps remain one of the most financially and environmentally sound upgrades for homes in Concord, MA.

Energy Efficiency and Year-Round Comfort

Heat pumps work by transferring heat instead of generating it, using a fraction of the energy required by conventional HVAC systems. Whether it’s during Concord’s cold January nights or muggy July days, heat pumps can both heat and cool efficiently.

Coupled with Concord’s increasingly longer stretches of hot weather and energy pricing pressures, upgrading to a heat pump is still one of the smartest home investments available.

Utility Winter Pricing Support

Utility providers in Massachusetts continue to offer winter reduced-rate programs to homeowners using eligible all-electric heating systems, which further enhances seasonal cost savings for those who fully convert their home to heat pumps.

If you're located in Concord and move toward full electrification, you may qualify for utility programs that reduce your heating costs during the peak winter months, offering ongoing operational savings in addition to the upfront rebates.

What Concord Homeowners Should Do Now

While program changes already affect how much you can save, the fact remains that Massachusetts continues to provide strong support for heat pump adoption—more than almost any other state. For residents of Concord, this period before further reductions represents a key opportunity to upgrade outdated and inefficient heating and cooling.

Key Takeaways for Concord Residents:

- Whole-home rebates now max out at $8,500, down from $10,000 in 2025

- New refrigerant rules mean R-410A systems no longer qualify

- Income-based programs still offer up to $16,000 or no-cost installations

- Federal tax credits have ended, reducing available incentives across the board

- Heat pump systems remain a future-proof investment in Massachusetts

- Mass Save® rebates decline each year—faster action equals stronger savings

Make sure any planned installation meets current refrigerant and efficiency requirements, and pursue your rebate sooner rather than later to avoid further reductions as the program evolves.

Visit the official Mass Save® rebate page for heat pumps for the most current information and approved system standards:

Mass Save® Air Source Heat Pumps

Staying informed and proactively navigating these program changes is essential for Concord homeowners aiming to transition to efficient, all-electric home systems in 2026 and beyond.

What Local Homeowners Are Saying

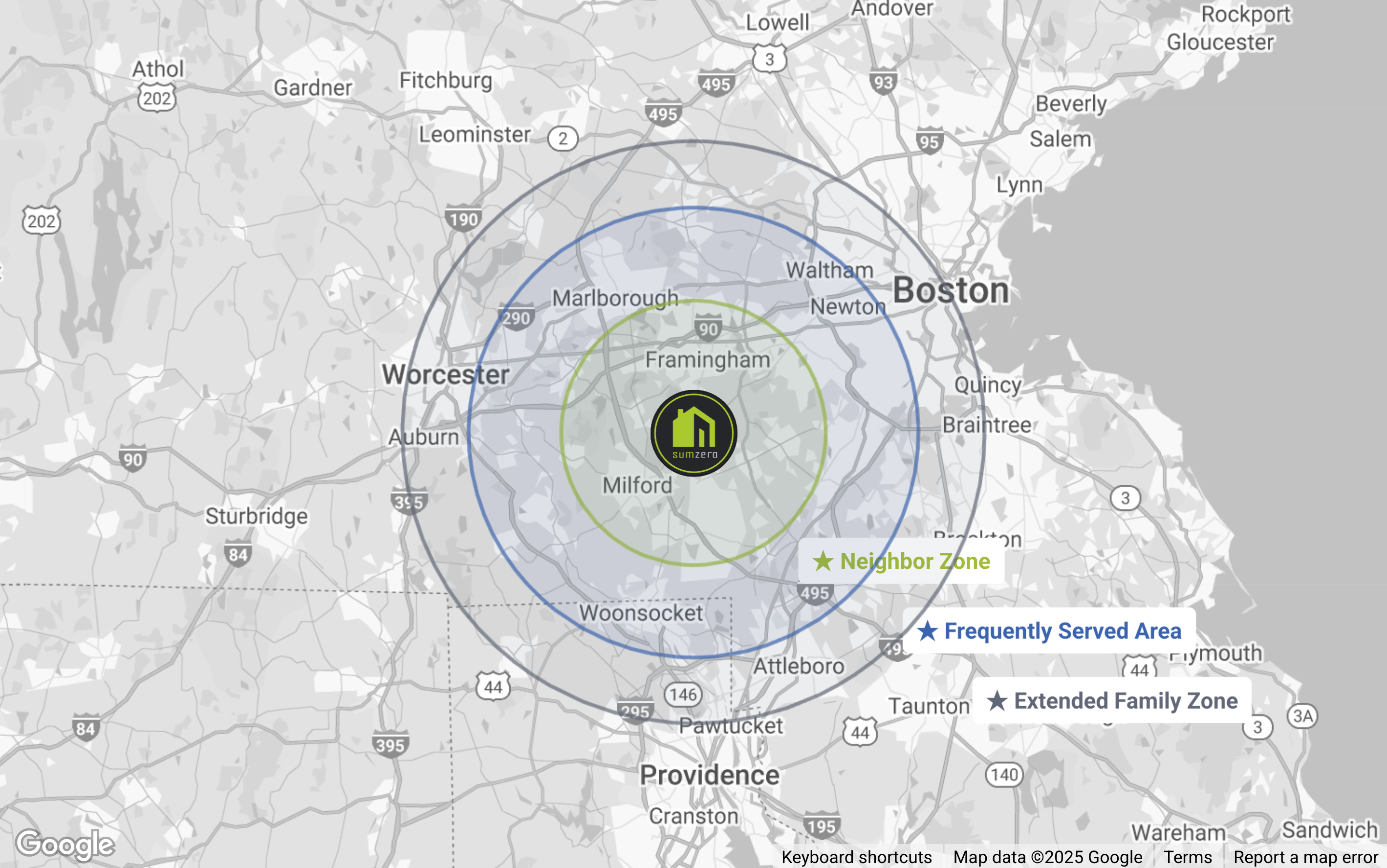

See how SumZero has helped local homeowners stay comfortable year-round with energy-efficient heat pump solutions.

Not Sure Where to Start? We’ll Guide You

Let our experts design the right heating and cooling solution—customized for your comfort, your layout, and your energy goals. No pressure. Just clarity.

Request FREE ESTIMATE