2026 Mass Save Rebates Reduced with New Eligibility Rules | Rebates & Tax Credits | Worcester, MA

Mass Save® rebates in Worcester are still available for 2026, but the maximum amount has dropped to $8,500 and tighter eligibility rules now apply. To qualify, homeowners must install heat pumps that meet strict efficiency standards and use approved low-GWP refrigerants, making early action essential to lock in higher incentives before further reductions.

2026 Mass Save Rebates: Reduced with New Eligibility Rules

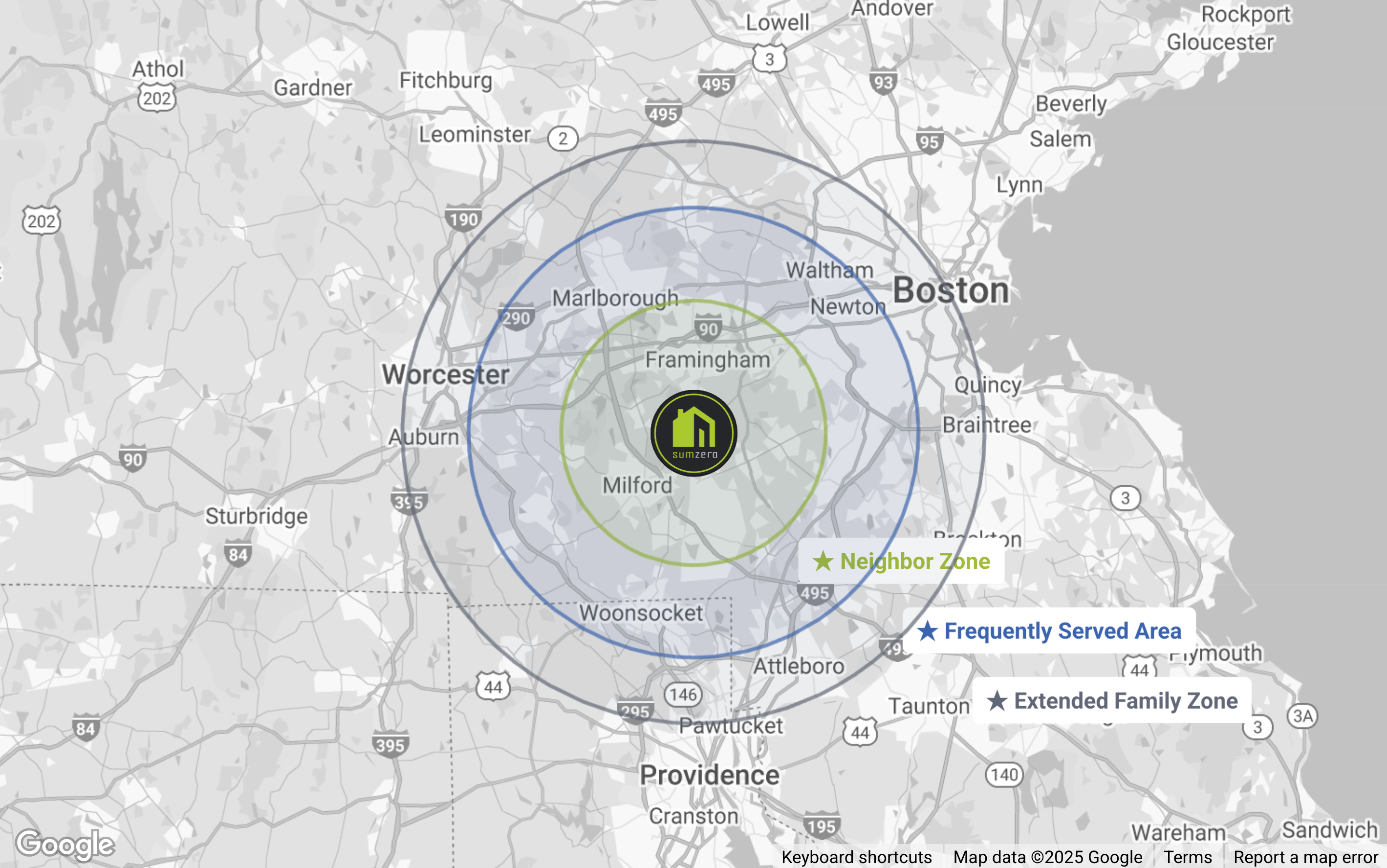

Worcester, Massachusetts homeowners are facing critical changes in home energy rebates for 2026. In recent years, Mass Save® rebates have helped countless families in Central Massachusetts switch to cleaner, more efficient heating and cooling systems—especially heat pumps. But homeowners here in Worcester must now act quickly: Starting in 2026, maximum rebate amounts drop and eligibility rules become significantly more restrictive.

If you're considering a heat pump system for your Worcester home, understanding the latest Mass Save® changes is key to getting the best return on your investment. At SumZero Energy Systems, we’ve closely tracked these shifts to help local homeowners make smart, timely energy upgrades.

“Energy-efficient upgrades are still being supported in Worcester, but the clock is ticking. Act now before incentives shrink further.”

This guide will walk you through the updated rebate amounts, revised qualification criteria, and what these changes mean for Greater Worcester residents thinking about modernizing their home heating and cooling in 2026.

2026 Mass Save® Program Changes for Worcester Homeowners

Homeowners across Worcester County need to know that starting January 2026, both the value and accessibility of Mass Save® rebates are changing significantly. Here's what’s coming.

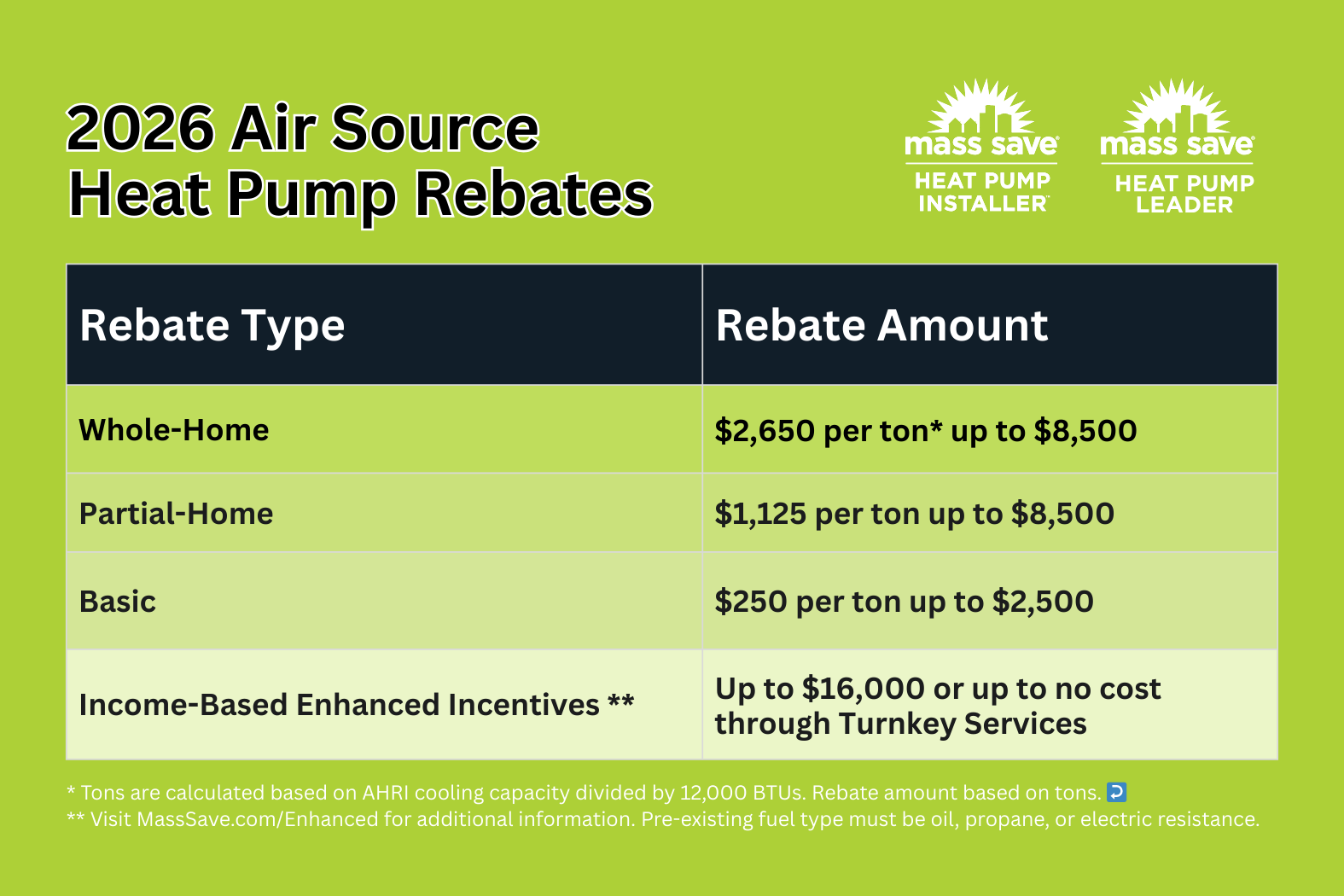

Heat Pump Rebates Drop by $1,500 from 2025

If you wait until 2026 to install your heat pump, you’ll miss out on the bigger savings being offered now. Maximum whole-home rebates, which were $10,000 in 2025, drop to $8,500 in 2026.

Breakdown of 2026 Mass Save® air-source heat pump rebates:

- Whole-Home Installations: $2,650 per ton, up to $8,500

- Partial-Home Installations: $1,125 per ton, up to $8,500

- Basic Rebates (limited criteria): $250 per ton, up to $2,500

- Income-Based Rebates: Up to $16,000 or potentially no-cost installation through Turnkey Services

Worcester homes—especially older buildings common in areas like Shrewsbury Street, Burncoat, and Tatnuck—often require full heating solutions. Whole-home installs provide the highest benefits, but only if you act before even more reductions occur.

Stricter Refrigerant and Efficiency Standards Take Effect

2026 rebates will no longer support heat pumps that use high global warming potential (GWP) refrigerants like R-410A. Instead, you must install systems that use approved low-GWP refrigerants, such as R-32 or R-454B, which are environmentally safer.

That means older equipment models and even some "newer" systems available in 2024 or 2025 will not qualify for rebates in 2026—even if they are highly efficient.

“Worcester homes looking to take advantage of rebates in 2026 must use heat pumps with low-GWP refrigerants. R-410A is no longer accepted.”

Visit the official Mass Save® Air-Source Heat Pump Rebates Page for real-time eligibility changes and approved equipment lists.

Why Timing Matters More Than Ever in Worcester

Delaying your heat pump upgrade could reduce your available rebate by thousands of dollars. With the reduction already in place for 2026, and further cuts possible in the future, acting now ensures maximum benefit for Worcester area homeowners.

Federal Tax Credits Now Unavailable After 2025

The federal tax credit—once a powerful additional incentive for switching to heat pumps—will not be available for installations completed in 2026. In 2025, many homeowners could combine Mass Save® rebates with federal credits to significantly lower their out-of-pocket costs.

Missing this dual opportunity means paying more overall for the same system.

Utility Seasonal Rate Programs Still Available

Worcester residents served by National Grid or Eversource may still benefit from winter electric rates specific to heat pump users. While this isn't part of Mass Save®, it’s an important long-term cost consideration for homes using electricity to heat and cool. These discounted electric heating rates remain active, particularly during the colder months, when efficient systems can make the greatest difference in comfort and cost.

“Worcester homes heated by energy-efficient heat pumps qualify for special winter electric rate programs from local utilities.”

Heat Pumps Remain the Smartest Way to Electrify in Central MA

Despite reduced rebates, heat pumps are still one of the most cost-effective and environmentally beneficial upgrades for Worcester homes. With improvements in technology, design, and operational efficiency, modern heat pump systems work exceptionally well even in our cold New England winters.

How Heat Pumps Work in Worcester’s Cold Climate

Many Worcester residents worry that heat pumps won’t keep up with the brutal winter temperatures we experience in New England. That’s no longer the case. Cold-climate-rated air-source heat pumps:

- Operate efficiently down to -5°F or lower

- Deliver 2–3x the heating energy compared to the electricity they use

- Can be zoned for room-by-room control, perfect for multi-level Worcester homes

When properly sized and installed by experts like SumZero Energy Systems, heat pumps can fully replace oil, propane, or baseboard electric heating systems—even in Worcester’s historic triple-deckers or mid-century ranch homes.

Long-Term Benefits Outweigh Short-Term Rebate Reductions

While the 2026 rebates are lower, investing in a modern heat pump system is still a financially sound decision:

- Year-round comfort (heating and cooling)

- Reduced carbon emissions

- Lower utility bills over time

- Dependence on stable, local electric supply rather than fluctuating oil or propane prices

These benefits can be particularly powerful for Worcester homes transitioning from outdated systems.

Understanding Income-Based Heat Pump Rebates

Mass Save® offers enhanced incentives to low-to-moderate income households through its Turnkey Services program. Worcester homeowners may qualify for rebates as high as $16,000—or receive a heat pump installation at no cost—if they meet certain income thresholds.

Who Qualifies for Enhanced Support?

Eligibility is based on household size and income. Worcester families earning below the area's median income guidelines may qualify, particularly those living in older homes with dated, inefficient heating systems.

These enhanced incentives are designed to promote energy equity, reduce utility burdens, and increase access to electrification—especially valuable in neighborhoods like Main South, Vernon Hill, and Piedmont.

What’s Included in Turnkey Services?

Turnkey Services through Mass Save® cover essentials like:

- Home energy assessments

- Heat pump design and system sizing

- Full installation by participating contractors

- Post-installation follow-up and performance checks

This is one of the most generous incentive programs still remaining intact in 2026—Worcester homeowners should investigate eligibility while funds last.

Making Sense of Your Options as a Worcester Homeowner

With stricter rules and reduced incentives now in place, making the right decision for your home requires more precision and planning than ever. SumZero Energy Systems, based right here in Worcester, is your local expert in understanding the 2026 changes and guiding you through successful electrification.

Common Home Heating Scenarios in Worcester

Every home is different, but some are particularly well-suited to high-efficiency upgrades:

- Oil-heated single-family homes looking to reduce fuel costs

- Older Victorian houses targeting phased upgrades

- Apartments or multi-family buildings integrating partial-home systems

- Ductless homes needing zoned, room-by-room control

Each of these common Worcester housing types can benefit from custom configurations—whether whole-home or partial—depending on layout, age of the home, and energy goals.

How to Maximize Your Rebate in 2026

To get the largest benefit before future reductions, Worcester homeowners should:

- Choose heat pumps that use low-GWP refrigerants, avoiding outdated models

- Commit to a whole-home installation if replacing a full heating system

- Complete projects early in the calendar year to avoid funding cuts

- Consult current rules on the Mass Save® Air-Source Heat Pump Page

Working with contractors who are up to speed on all 2026 Mass Save® changes—like SumZero—ensures you don’t miss out on key savings during this transition period.

Final Thoughts: Act Sooner to Save Bigger in Worcester

2026 brings a clear message to Worcester homeowners: rebates aren’t going up, they’re going down. And with stricter rules governing what qualifies, waiting could mean settling for less support or missing vital opportunities altogether. But informed homeowners who move early and choose qualifying systems still have access to thousands of dollars in incentives.

Worcester’s evolving building codes, harsher winters, and diverse housing stock mean heat pumps remain not just viable—but advantageous. Even under the 2026 Mass Save® structure, it’s still possible to make an energy-efficient choice that’s good for both your wallet and the environment.

Be proactive and well-informed. The rebates are still here in 2026—but for homeowners in Worcester, the best time to act is now.

What Local Homeowners Are Saying

See how SumZero has helped local homeowners stay comfortable year-round with energy-efficient heat pump solutions.

Not Sure Where to Start? We’ll Guide You

Let our experts design the right heating and cooling solution—customized for your comfort, your layout, and your energy goals. No pressure. Just clarity.

Request FREE ESTIMATE