2026 Mass Save Heat Pump Rebate Changes and Eligibility | Rebates & Tax Credits | Wakefield, MA

The 2026 Mass Save heat pump rebate changes bring reduced incentives and updated qualification rules for Wakefield homeowners looking to upgrade their home heating systems. While rebates are still available—up to $8,500 for qualified whole-home installations—eligibility now depends on using approved low-GWP refrigerants, making early action key to maximizing savings.

2026 Mass Save Heat Pump Rebate Changes and Eligibility

Wakefield, MA homeowners have long relied on Mass Save® rebates to make energy-efficient home upgrades more affordable. But in 2026, those rebates for air-source heat pumps are undergoing major changes—smaller incentives, tighter requirements, and a growing urgency to act before more reductions take effect. At SumZero Energy Systems, we understand how important heating and cooling is in a town where winters get frigid and summers increasingly demand efficient cooling. Navigating the Mass Save program in 2026 isn’t just about system efficiency—it’s also about refrigerant types, installation scope, and timing. This guide will walk Wakefield residents through everything they need to know to make an informed decision.

“Homeowners in Wakefield, MA have a limited window to access the best heat pump rebates before stricter eligibility rules and reduced incentives fully take hold.”—SumZero Energy Systems

Understanding the 2026 Mass Save Heat Pump Rebates

The Mass Save® rebates in 2026 are still very much active—but they’ve changed. If you were waiting to upgrade your HVAC system in 2026, it’s crucial to know how incentives differ today from what was available in 2025.

What Has Changed in 2026?

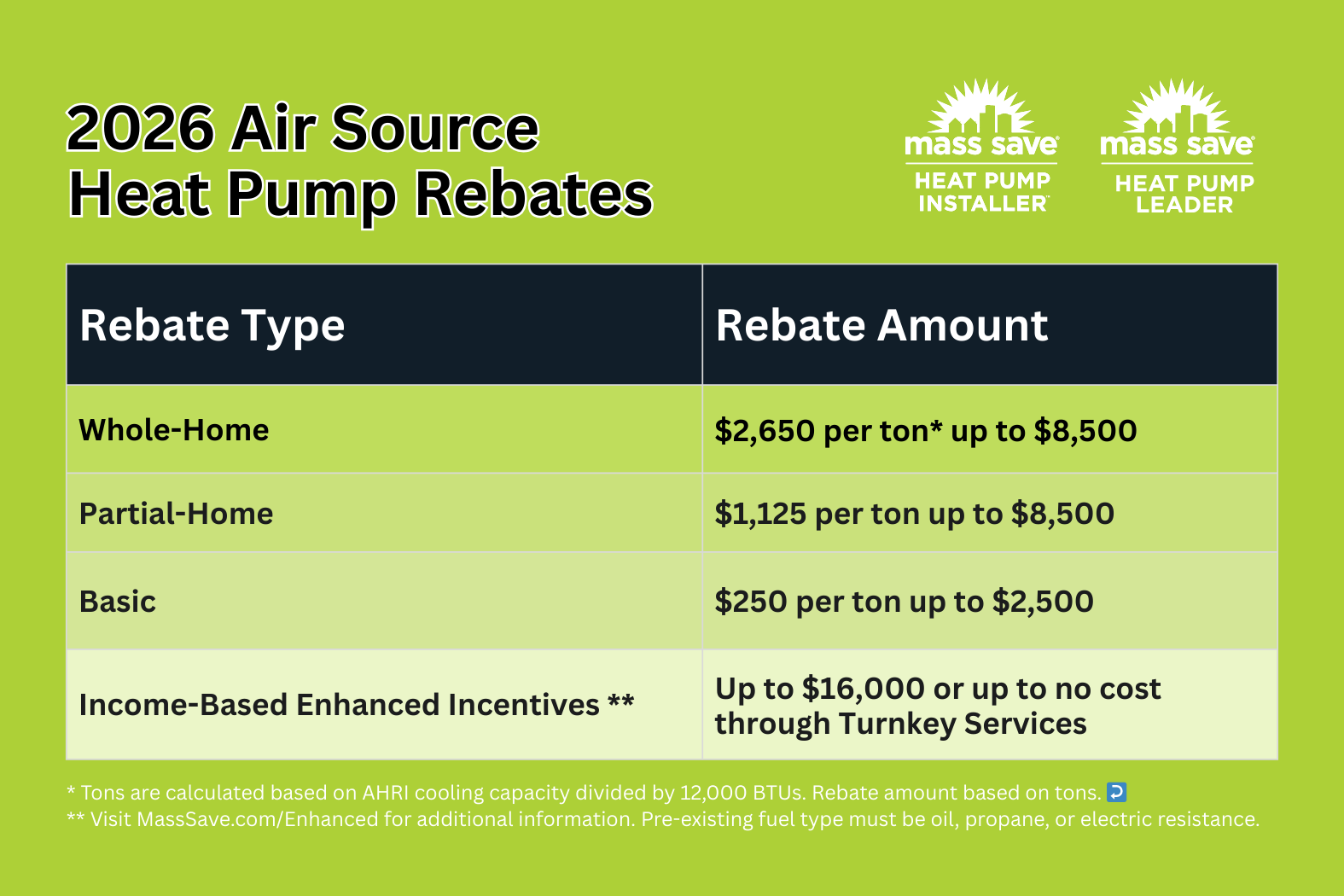

Starting in 2026, the maximum rebate available for installing air-source heat pumps has dropped by $1,500 from 2025 levels. Where last year you could receive up to $10,000 for a whole-home system, this year the top-level incentive is capped at $8,500. This change reflects Mass Save’s intended phase-down of generous incentives as the statewide electrification effort matures.

- Whole-Home Rebate: $2,650 per ton, up to $8,500

- Partial-Home Rebate: $1,125 per ton, up to $8,500

- Basic Rebate: $250 per ton, up to $2,500

- Income-Based Enhanced Incentives: Up to $16,000 or possibly full cost coverage through Turnkey Services

These changes are prompting savvy homeowners to act fast. Delays might mean losing out on valuable savings.

How Wakefield’s Climate Affects Rebate Relevance

Wakefield is located in an area where summers are increasingly humid and winters routinely fall into the single digits. A properly sized, cold-climate heat pump is not just a luxury—it’s a necessity. These heating and cooling systems keep comfort levels high while using significantly less energy than traditional oil or gas systems.

A high-efficiency heat pump designed for Massachusetts’ climate can:

- Maintain heating even when outdoor temps drop below 0°F

- Reduce your dependence on costly fossil fuels

- Qualify you for Mass Save incentives when expertly installed and approved

“High-efficiency heat pumps are practically built for Massachusetts winters—especially when designed for cold-climate performance.”—SumZero Energy Systems

Key Eligibility Changes in 2026

To qualify for remaining Mass Save® rebates, homeowners must meet more precise guidelines. It’s not just about getting a heat pump—it’s about getting the right kind, installed the right way.

Refrigerant Rules: R-410A No Longer Qualifies

As of 2026, Mass Save has disqualified systems using R-410A—a refrigerant with high Global Warming Potential (GWP). Only newer models with low-GWP refrigerants like R-32 or other environmentally approved alternatives qualify for rebates.

If you’re considering a heat pump upgrade, make sure to verify the refrigerant compatibility with Mass Save 2026 requirements. This makes older stock systems or leftover 2025 inventory a risk you're better off avoiding.

Federal Tax Credits Have Been Eliminated

Another important development? The federal heat pump tax credits that helped improve affordability in recent years have been discontinued in 2026. That puts even more weight on state-based rebate programs for financial relief.

Massachusetts residents now have fewer layers of financial support when investing in a heat pump system, making the timing of your installation—and your chosen installer—even more critical.

Choosing the Right Rebate Path for Your Wakefield Home

Understanding which rebate category applies to your situation will influence how much you save on your heat pump installation. Your home’s layout and heating needs determine whether it qualifies as a “whole-home” or “partial-home” system.

Whole-Home Installation: Best Value, Maximum Savings

Whole-home rebates apply when a qualified air-source heat pump becomes the only heating source within your home. For Wakefield homeowners transitioning fully off oil or gas, this rebate often provides the best possible savings.

- $2,650 per ton, up to $8,500

- Must provide 100% heating load coverage

- No fossil fuel backup heat permitted

System design and load calculations must be approved, which is why working with qualified contractors like SumZero Energy Systems is essential.

Partial-Home and Basic Rebates: Flexible Yet Limited

Partial-home rebates can still offer meaningful savings—especially for homes using heat pumps to supplement existing baseboard or boiler systems.

- $1,125 per ton, up to $8,500

- Integrates with fossil fuel or other heat systems

- Great for phased upgrades or lower budgets

Basic rebates at $250 per ton (up to $2,500) are also available where no integrated control systems exist, or where performance doesn’t meet newer eligibility tiers.

Income-Based Enhanced Offers in Wakefield

If you're a resident of Wakefield and meet certain income thresholds, you may qualify for enhanced incentives through Mass Save’s Turnkey Services. These enhanced benefits can fund up to $16,000, or in some cases, cover the entire cost of a new heat pump system.

Eligibility depends on household size and income. If you're enrolled in state-based programs like LIHEAP, WIC, or SNAP—you're likely to qualify easily.

Enhanced incentives include:

- Free or deeply discounted installation

- Streamlined contractor partnerships through Mass Save

- Based on Area Median Income (AMI) levels

Learn more through the official Mass Save Air Source Heat Pump Program.

Why Timing Still Matters in 2026

One of the most important truths about Mass Save’s heat pump rebates: they’re not increasing—they're decreasing over time. The earlier you participate, the more you stand to gain. This is especially true in 2026 and beyond when yet more reductions are likely.

Rebates Are Phasing Down Each Year

The 2026 drop of $1,500 in maximum rebate is just the latest in a series of reductions that aim to wind down long-term incentives. Waiting too long could mean paying more for the same system, even if your home qualifies today.

You’ll also face stricter hardware requirements, making it harder to meet criteria without a full HVAC overhaul.

Contractors and Permitting Can Delay Projects

In heavily populated areas like Wakefield and the greater North Shore, HVAC contractors become booked early in the spring and summer when rebate demand spikes. Avoid seasonal backlogs and missed opportunities by scheduling early and planning ahead for:

- Site assessments

- Load calculations

- Permit approvals

- Equipment ordering and lead time

“Delays could mean missing out on currently available rebates—especially when equipment specifications or permitting complications come into play.”—SumZero Energy Systems

Utility Programs and Energy-Saving in Winter

Many residents in Wakefield ask if winter discount programs are still available when switching away from fossil fuels. The answer is yes—your utility company may have reduced winter rates if you shift to electric heating with a qualifying system.

Utility Provider Discounts Still Apply

Some Massachusetts electric utilities offer time-of-use (TOU) or winter discount rates for homes with electric heat. These discounts can amplify the benefits of a high-efficiency cold-climate heat pump installation.

Contact your electricity provider to see if your planned heat pump qualifies you for:

- Seasonal electric rate reductions

- Smart thermostat integration bonuses

- Load management programs

Additional Energy-Saving Benefits from Heat Pumps

Besides lower utility costs, switching to a heat pump provides:

- Consistent comfort across all seasons

- Better indoor air quality and humidity control

- Lower maintenance compared to furnace or boiler systems

- Elimination of oil deliveries and carbon monoxide risks

Qualified systems also contribute to statewide green energy goals and boost your home’s resale value.

Heat Pumps Remain the Most Supported Electrification Upgrade

While incentives are falling, heat pumps continue to receive the broadest support through Mass Save and utility programs. This speaks to their effectiveness in replacing fossil fuel systems and cutting greenhouse gas emissions at the residential level.

Heat Pump Incentives Outpace Other Upgrades

Compared to other electrification improvements like solar panels, battery storage, or EV chargers, heat pumps remain the top-priority measure for Mass Save rebates—especially in heating-dominated regions like Wakefield.

Rebate funds still cover both equipment and installation, so homeowner cash outlay stays limited.

Local Momentum and Massachusetts Policy

Massachusetts remains a leader in decarbonization policy. Heat pumps play a central role in those efforts—especially in transition towns like Wakefield, where aging homes often feature less efficient baseboard or boiler systems.

By upgrading now, you're future-proofing your home and aligning with long-term infrastructure trends—while getting paid to do it.

If you’re a homeowner in Wakefield, MA thinking about converting to an energy-efficient heat pump system, now is the time to act. The 2026 rebate amounts have dropped, eligibility is tightening, and further reductions are likely. By staying ahead of the changes and choosing the right installation path, you can still lock in exceptional savings under the Mass Save program and prepare your home for a smoother, eco-friendly future.

What Local Homeowners Are Saying

See how SumZero has helped local homeowners stay comfortable year-round with energy-efficient heat pump solutions.

Not Sure Where to Start? We’ll Guide You

Let our experts design the right heating and cooling solution—customized for your comfort, your layout, and your energy goals. No pressure. Just clarity.

Request FREE ESTIMATE