2026 Mass Save Heat Pump Rebates and Eligibility Updates | Rebates & Tax Credits | Hudson, MA

2026 Mass Save heat pump rebates offer valuable incentives for Hudson homeowners upgrading to energy-efficient systems—but new rules and reduced payouts mean timing is critical. With rebates now up to $8,500 (down from $10,000 in 2025) and updated eligibility requiring low-GWP refrigerants, understanding the latest changes ensures you maximize your savings before incentives decline further.

2026 Mass Save Heat Pump Rebates and Eligibility Updates

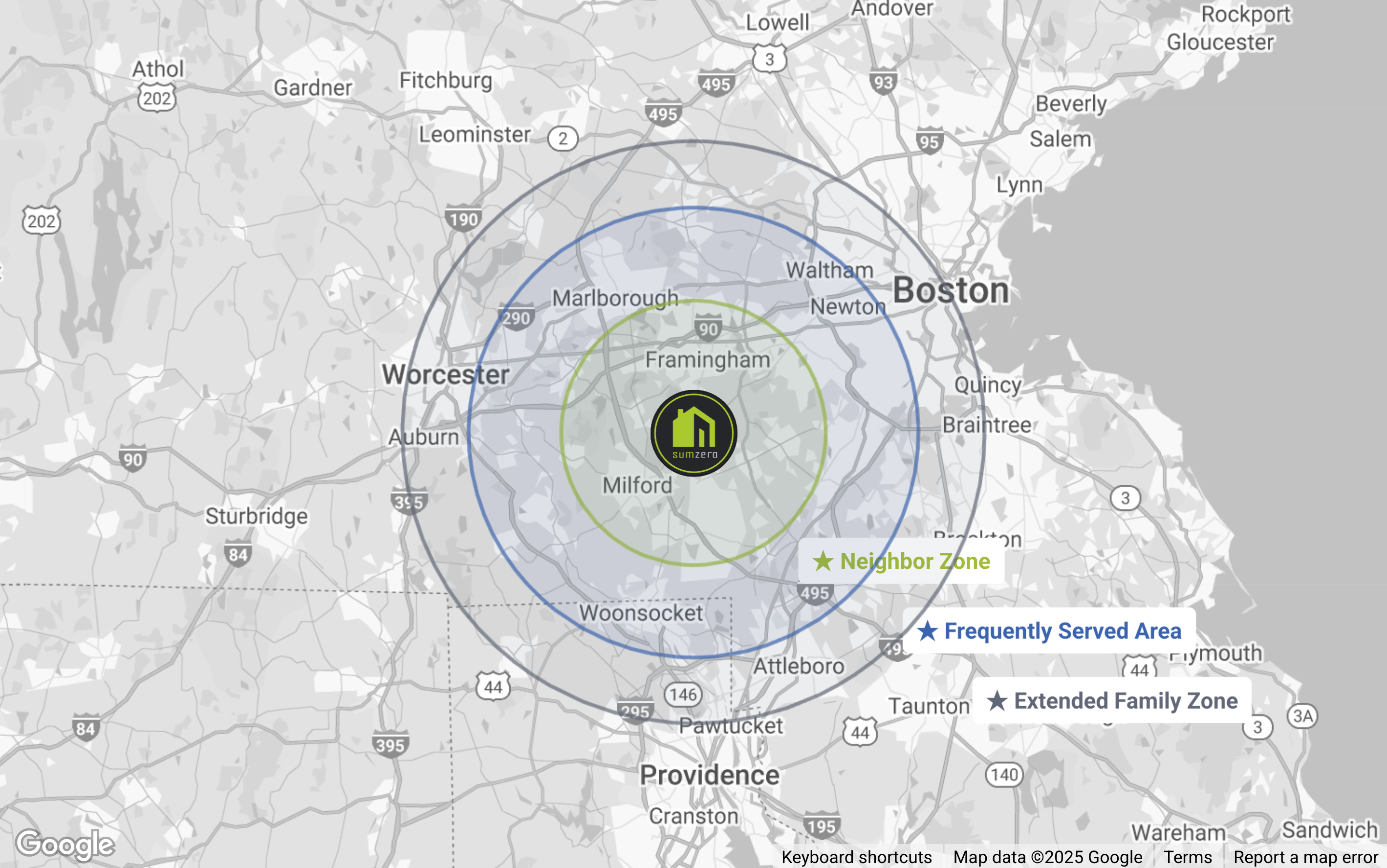

Homeowners in Hudson, Massachusetts, know how unpredictable New England weather can be—from icy winters to sweltering summers. That’s why energy-efficient heating and cooling solutions like heat pumps have continued to gain popularity across Middlesex County. As of 2026, SumZero Energy Systems is helping local residents navigate updates to the Mass Save® heat pump rebate program, ensuring you make informed decisions and access the most cost-effective electrification upgrades available.

The latest changes to Mass Save incentives present both opportunities and challenges. While rebates are still available, the amounts have been reduced, and eligibility criteria have become more selective. For Hudson-area homeowners considering a home energy upgrade, understanding these changes—and acting quickly—can make a significant difference.

Understanding the 2026 Mass Save® Heat Pump Rebates

Mass Save® continues to offer financial incentives for homeowners replacing conventional HVAC systems with efficient air-source heat pumps. However, 2026 marks notable changes from previous years.

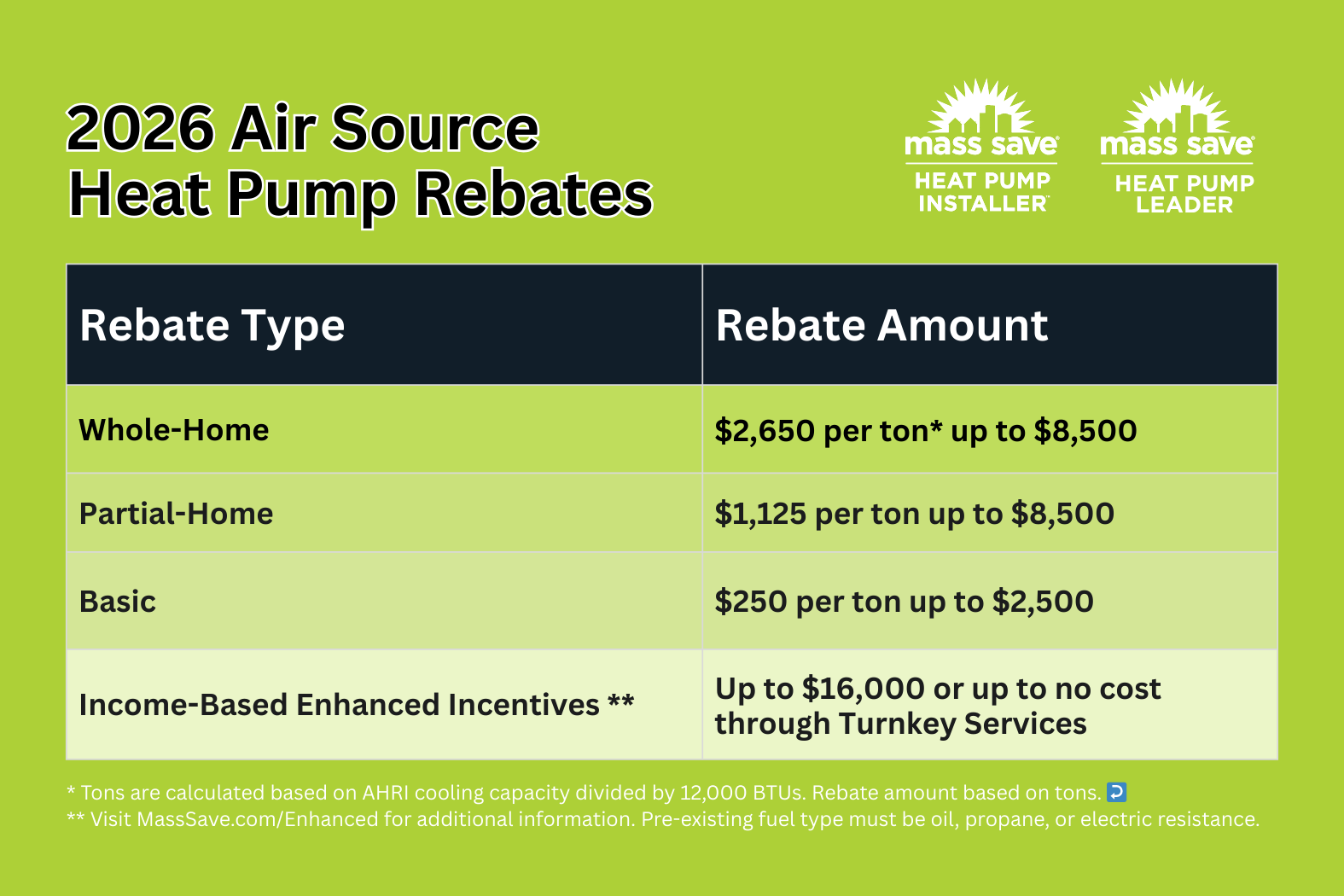

2026 Rebate Levels Have Been Reduced

Compared to 2025, rebate values have dropped by $1,500, showing a clear shift in program policy.

- Whole-Home Rebate: $2,650 per ton, up to a maximum of $8,500

- Partial-Home Rebate: $1,125 per ton, up to $8,500

- Basic Rebate: $250 per ton, capped at $2,500

- Income-Based Incentives: Up to $16,000 or up to no cost through Turnkey Services

“Whether you live in Hudson Center or just south of Main Street, the 2026 Mass Save cuts make it essential to lock in your rebate early before additional reductions take place.”

For eligible residents, the highest incentives are still reserved for those committing to full-home electrification or qualifying for income-based assistance.

Eligibility Is No Longer Just About Efficiency Ratings

While heat pump efficiency metrics like SEER and HSPF still matter, a major change for 2026 is the new refrigerant standard.

Older heat pumps that rely on R-410A refrigerants are now ineligible for rebates. To qualify, your system must use low-GWP (Global Warming Potential) refrigerants approved by the Mass Save program.

Details on qualified systems can be found directly on the Mass Save website.

Why Hudson Homeowners Should Act Now

The reduced rebate rates for 2026 reflect a broader shift away from generous financial incentives. Timing has never been more important for securing rebates and upgrading your home's HVAC in Hudson, MA.

Incentives Will Likely Continue Declining

Mass Save’s 2026 updates indicate a pattern: rebate values are decreasing year-over-year. This trajectory is unlikely to reverse.

- $10,000 maximum in 2025

- $8,500 maximum in 2026

- Possible future reductions in 2027

Waiting could mean receiving less money, dealing with more complex requirements, or missing out altogether.

“Many Hudson homes are ideal for heat pump upgrades, but delaying installation could make the difference between saving $8,500 and saving nothing.”

Federal Tax Credits Are No Longer Available

Homeowners once relied on federal tax credits to supplement state-based rebates. As of 2026, those credits are no longer available for heat pumps. This strengthens the case for quickly securing what’s still offered through Mass Save.

What Hudson, MA Residents Need to Know About Qualified Heat Pumps

Not all heat pumps are eligible for Mass Save rebates. Homeowners must now pay close attention to both system design and refrigerant type.

Approved Low-GWP Refrigerants Are Mandatory

Mass Save's 2026 criteria require that all new systems use eco-friendly refrigerants. R-410A, which was standard in prior years, is no longer compliant.

Qualifying refrigerants must meet nationally recognized low-GWP standards, reducing environmental impact and aligning with Massachusetts' broader emissions goals.

“If your contractor still offers R-410A systems in 2026, they’re not keeping up with the new rules—and you could miss your rebate.”

Efficiency Requirements Still Apply

Beyond refrigerants, your system must meet Mass Save minimum energy performance standards, which include:

- SEER2 (Seasonal Energy Efficiency Ratio)

- HSPF2 (Heating Seasonal Performance Factor)

SumZero ensures all systems we install meet or exceed these benchmarks to maximize your rebate eligibility.

Rebate Scenarios Based on Home Type in Hudson

Whether you're cooling a colonial near Downtown Hudson or heating a split-level home along Chestnut Street, your rebate amount varies based on your home's configuration and energy goals.

Whole-Home Rebates: Best for Full Electrification

These are ideal for homeowners who remove existing fossil fuel systems and commit fully to electric heating and cooling.

- Maximum Rebate: $8,500

- Requirement: Must serve 100% of conditioned space

- Must use Heat Pump as sole heating source

Partial-Home Rebates: For Gradual Upgrades

If you’re supplementing existing systems or upgrading a portion of your home, this rebate still offers substantial savings.

- Rebate Rate: $1,125 per ton

- Condition: Can include integrated fossil fuel or resistance heating systems

“In neighborhoods like Brigham Hill or Lake Boone, partial-home rebates help residents upgrade in stages without full system replacement all at once.”

Middle-Income or Lower-Income? You May Qualify for Enhanced Incentives

For Hudson residents who meet income criteria, the Mass Save program offers enhanced benefits under the Turnkey Services model.

Turnkey Services: Complete System With Minimal Cost

This route offers up to $16,000 in rebates—or even heat pump installation at no cost—for income-eligible households.

Eligibility is based on:

- Household income

- Number of residents

- Home ownership status (primary residence only)

Zero-Cost Installation Is Possible

Under Turnkey Services, qualified residents are directly assisted by authorized contractors and program administrators to streamline:

- Equipment selection

- Installation

- Rebate processing

Hudson households that qualify should move quickly, as funding is finite and distributed on a first-come, first-served basis.

Winter Reduced Rate Programs Are Still Available Through Utility Providers

Beyond rebates, some Hudson-area utility providers continue to offer winter reduced-rate electricity programs. These rates lower the cost of operating heat pumps when used during peak heating months.

Benefits of Winter Reduced Rates

- Lower electricity costs from November through April

- Encourages off-peak heating system usage

- Potential to further offset upfront installation expenses

Check With Local Providers

Utilities like National Grid and Eversource typically administer these programs in Massachusetts. Hudson homeowners should consult their provider directly to explore qualification and enrollment.

How SumZero Energy Systems Supports Hudson Homeowners

SumZero Energy Systems is based in Hudson, MA—so when you work with us, you’re partnering with a local team who understands the climate, the neighborhoods, and what rebates really mean for Middlesex residents.

Personalized Heat Pump Systems Designed for Your Home

From Chestnut Street to Route 62, different homes have different HVAC needs. Whether you live in a two-story colonial or a ranch home, our systems are tailored for optimal heating performance and efficiency.

- We assess your current system and heating loads

- Recommend equipment with eligible refrigerants

- Handle all rebate paperwork with Mass Save on your behalf

Staying Ahead of Mass Save Changes

Our team continuously monitors Mass Save guidelines, helping us adjust installations with zero margin for error. As the program evolves, SumZero ensures your system remains compliant and future-proofed for maximum performance and savings.

Conclusion: Navigating 2026 With the Right Partner Matters

Heat pumps remain one of the most incentivized and eco-efficient home upgrades available in Massachusetts—even as rebates drop, eligibility tightens, and federal credits disappear. As a locally-owned and operated company in Hudson, SumZero Energy Systems helps you make confident, cost-effective decisions while securing every possible rebate before programs change again.

For more eligibility details and up-to-date rebate information, visit the official Mass Save heat pump rebate page.

What Local Homeowners Are Saying

See how SumZero has helped local homeowners stay comfortable year-round with energy-efficient heat pump solutions.

Not Sure Where to Start? We’ll Guide You

Let our experts design the right heating and cooling solution—customized for your comfort, your layout, and your energy goals. No pressure. Just clarity.

Request FREE ESTIMATE