2026 Mass Save Heat Pump Rebate Changes and Rules | Rebates & Tax Credits | Bedford, MA

2026 Mass Save heat pump rebates offer valuable incentives for Bedford homeowners upgrading to energy-efficient heating and cooling systems, but key program changes have taken effect. With rebate amounts lowered by up to $1,500 from 2025 and new rules requiring low-GWP refrigerants, acting early is the best way to maximize your savings under the updated Mass Save guidelines.

2026 Mass Save Heat Pump Rebate Changes and Rules

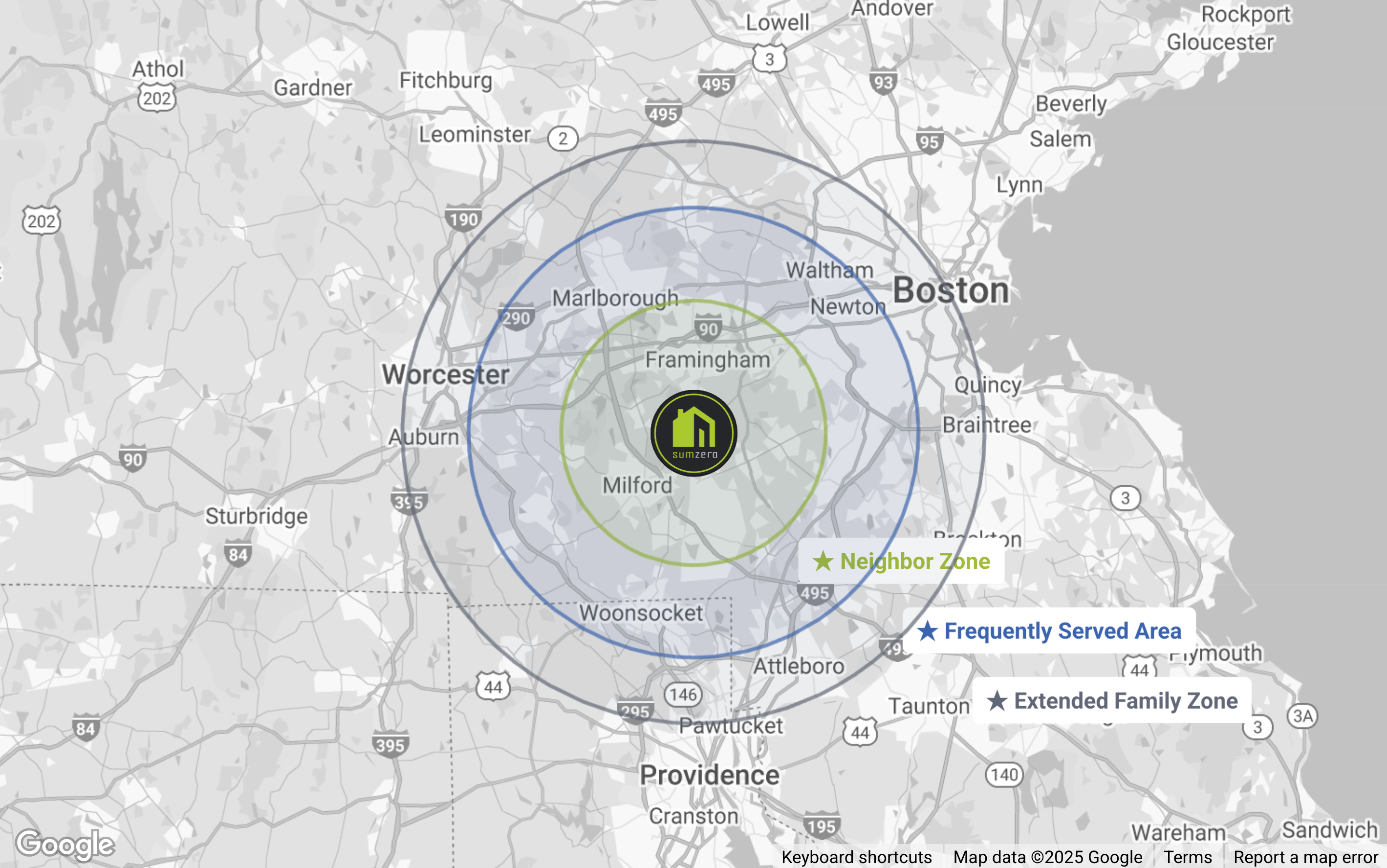

Upgrading to clean energy in Bedford, MA isn’t just a smart choice—it’s quickly becoming a financial one, too. But as we move deeper into 2026, understanding the evolving landscape of Mass Save® heat pump rebates is more critical than ever for Middlesex County residents. With rebate amounts reduced and eligibility tightened, Bedford homeowners looking to electrify their homes need to stay ahead of the changes.

At SumZero Energy Systems, based right here in Bedford, we stay up to date with Massachusetts energy programs to ensure you make informed, cost-effective decisions on your home heating and cooling systems. If you're evaluating heat pump installation in 2026, here’s what you need to know about rebates, requirements, and timing.

What’s New in the 2026 Mass Save® Heat Pump Rebates?

Mass Save® continues to offer incentives for residential air source heat pumps across Massachusetts, but the structure and value of rebates have changed significantly compared to prior years.

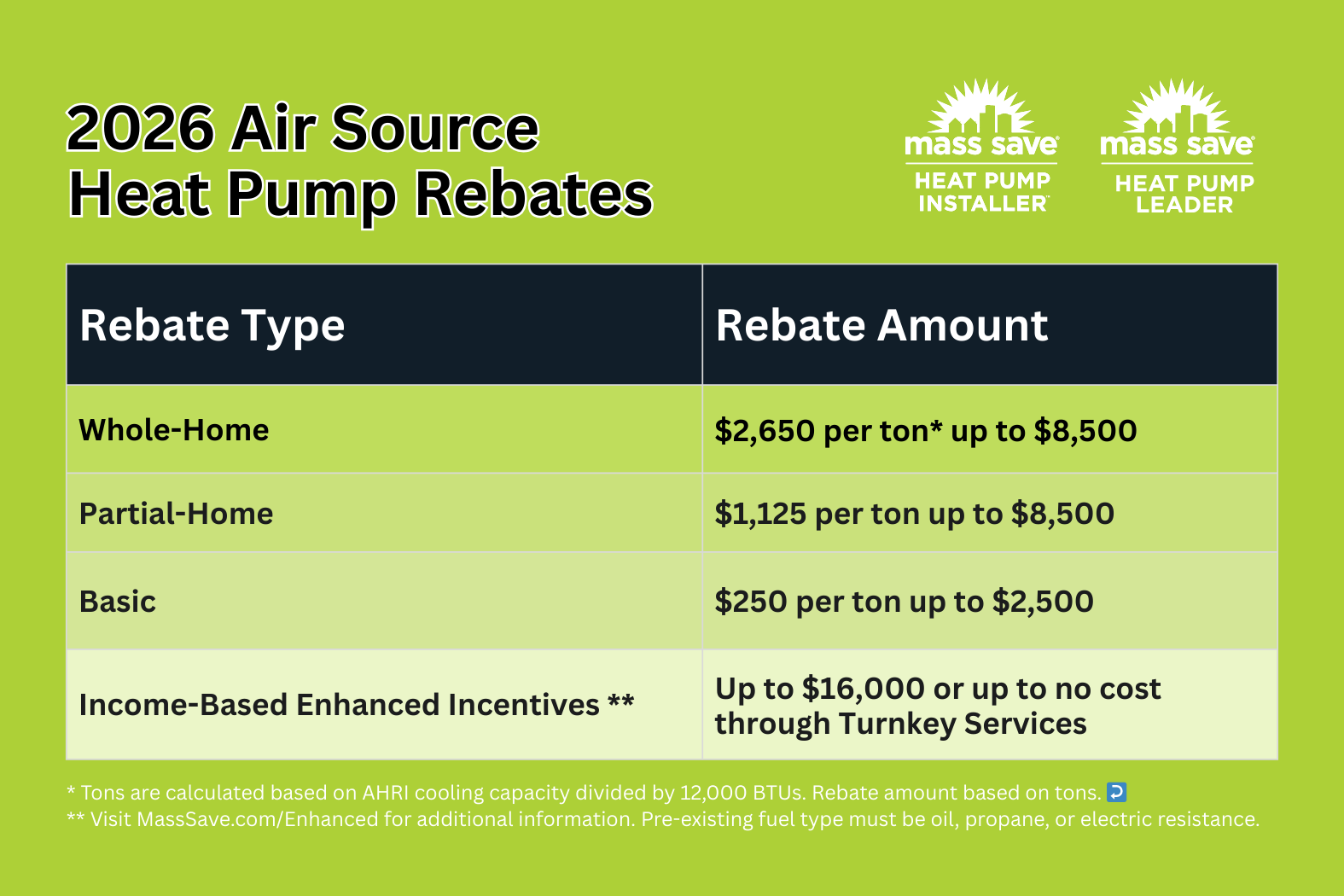

2026 Rebate Reductions You Should Know

One of the most notable changes in 2026 is the $1,500 reduction in rebate limits compared to 2025 offerings. If you were eligible for up to $10,000 last year, the new ceiling is now $8,500. Here's the breakdown by installation type:

- Whole-Home Rebate: $2,650 per ton, up to $8,500

- Partial-Home Rebate: $1,125 per ton, up to $8,500

- Basic Rebate: $250 per ton, up to $2,500

- Income-Based Enhanced Incentives: Up to $16,000 or even full system cost coverage through turnkey utility services

These lower incentive levels come at a time when inflation continues to impact installation costs. That means the sooner Bedford residents act, the more they'll likely save.

“We tell our Bedford clients: Each year you wait, you may be leaving free money on the table if rebate reductions continue.”

Heat Pump Requirements Have Tightened

In 2026, eligibility for Mass Save® rebates now depends on more than just equipment efficiency. Not all ENERGY STAR®-certified systems automatically qualify. Important new criteria include:

- Refrigerant Type: R-410A systems are no longer eligible. Approved systems must now use low-GWP (Global Warming Potential) refrigerants, helping reduce climate impact.

- Minimum Efficiency Ratings: Systems must meet strict SEER2 and HSPF2 performance benchmarks to qualify.

Mass Save® requires utilizing a qualified contractor for rebates—SumZero Energy Systems is a proud participant in the Mass Save® Heat Pump Installer Network, ensuring your system meets all modern standards.

Why Bedford Homeowners Should Still Consider Heat Pumps in 2026

Although rebates have declined, heat pumps continue to be one of the most supported and sustainable upgrades available in Massachusetts—and they’re particularly effective for homes in Bedford.

Heat Pumps Are Ideal for New England’s Seasonal Shifts

The climate in Bedford, MA presents hot, humid summers and long, cold winters. High-efficiency air source heat pumps now provide year-round comfort, with low-temperature performance that rivals traditional fossil fuel systems. Today’s systems can effectively heat homes even when outdoor temperatures drop below 5°F, perfect for a typical Bedford winter.

Notable benefits include:

- Consistent indoor air comfort across seasons

- Lower annual heating and cooling bills

- Reduced reliance on oil or propane

- Quiet and flexible ducted or ductless system options

“Modern cold-climate heat pumps are designed with Bedford winters in mind—reliable even when the mercury dips.”

Utility Provider Rate Programs Support Savings

Many Bedford-area utility providers, including Eversource and National Grid, offer winter reduced-rate programs. These provide discounted electricity pricing during colder months, further improving the annual cost effectiveness of running an electric heat pump.

Be sure to ask your utility provider or your local contractor about eligibility or automatic enrollment in these programs once your heat pump is operational.

Decoding Whole-Home vs. Partial-Home Rebates in 2026

Understanding your path to rebate eligibility starts with knowing which category your installation falls under.

Whole-Home Heat Pump Installations

Whole-home systems offer the highest rebates but also the strictest requirements. This rebate option applies if:

- The new system provides 100% of your home’s heating and cooling load.

- All fossil-fuel heating equipment is removed or entirely disconnected.

- An independent third-party verifies system capacity and load through an approved heat load calculation.

For these installations, you'll be eligible for up to $2,650 per ton, capped at $8,500 total.

Partial-Home and Basic Installations

If you aren’t ready to ditch your oil or gas furnace entirely, partial-home and basic rebates still apply:

- Partial-Home: Allows integration with fossil systems but offers a smaller rebate of $1,125 per ton, capped at $8,500.

- Basic: For minimal installs or one-zone heat pump setups, you may qualify for $250 per ton, capped at $2,500.

This tiered system ensures homeowners pursuing partial electrification still receive some benefit.

“Partial-home rebates unlock access for Bedford homeowners not yet ready to transition fully off fossil fuels—but acting now secures these while they’re still offered.”

Enhanced Incentives for Income-Eligible Households

Massachusetts remains committed to energy equity. In 2026, qualifying Bedford households may receive up to $16,000 or even full equipment and installation coverage under the Enhanced Incentives program.

Who Qualifies?

Eligibility is based on household income and other criteria. Residents may qualify for no-cost or near-cost systems if they fall within designated income brackets. You must apply through the Mass Save® Home Energy Assessment program and participate in Turnkey Services provided by your utility.

Learn more or apply by visiting the official Mass Save rebate hub: Mass Save Heat Pump Rebates.

Extra Steps for Enrollment

Enhanced Incentives do require more documentation and energy assessments. However, SumZero Energy Systems helps facilitate this seamless process for Bedford homeowners, guiding you through qualification and installation from start to finish.

Key 2026 Timing Factors for Bedford, MA Residents

Waiting to install your heat pump doesn’t pay—literally. The long-term trend points toward decreasing rebates and tightening eligibility.

Why Timing Matters

Mass Save® has signaled that incentives will continue reducing annually as Massachusetts pushes toward market maturity and widespread electrification.

Delaying installation could mean:

- A smaller rebate purse

- Loss of eligibility under future stricter rules

- Missing out on remaining federal tax-based credits which have already been eliminated as of 2026

Federal Tax Credits: No Longer Available

As of 2026, homeowners installing heat pumps can no longer claim tax credits under the federal Energy Efficient Home Improvement Credit (25C). This places more emphasis on locking in current state-level rebates while they're still accessible.

If you’re depending entirely on local incentives, acting in 2026 makes a measurable difference in total project cost.

Working with Qualified Contractors Like SumZero in Bedford

Choosing the right installer ensures your system is designed, permitted, and installed in a way that meets Mass Save® requirements—which is now more stringent than in past years.

Why Local Expertise Matters

SumZero Energy Systems has deep experience with home styles common in Bedford:

- Older New England-style homes with duct retrofit needs

- Colonials and Capes ideal for ductless mini-splits

- Modern builds compatible with high-efficiency central systems

We perform all necessary home load calculations, ensure refrigerant compliance, and match your system to the best rebate path.

Avoiding Rebate Denials and Compliance Errors

Too many MA homeowners have faced denied rebates due to:

- Using unqualified equipment

- Working with non-network contractors

- Improper sizing or low-GWP refrigerant noncompliance

SumZero Energy Systems helps avoid these pitfalls while maximizing your incentive eligibility.

Summary: What Bedford Homeowners Should Do in 2026

If you live in Bedford and are considering an energy upgrade in 2026, installing a heat pump remains one of the most beneficial paths—financially and environmentally. But navigating the changed rebate structure requires attention to detail and local knowledge.

- Select the right rebate type (Whole-Home vs. Partial-Home)

- Ensure your system uses low-GWP refrigerants

- Work with a qualified Mass Save® contractor

- Act now to capture better incentives before future reductions

- Explore utility winter reduced-rate programs for added savings

Find the latest updates or apply for your Massachusetts air source heat pump rebate at: Mass Save – Air Source Heat Pumps

By staying informed and acting promptly, you’ll be positioned to enjoy year-round comfort, lower utility bills, reduced emissions—and better rebates while they last.

What Local Homeowners Are Saying

See how SumZero has helped local homeowners stay comfortable year-round with energy-efficient heat pump solutions.

Not Sure Where to Start? We’ll Guide You

Let our experts design the right heating and cooling solution—customized for your comfort, your layout, and your energy goals. No pressure. Just clarity.

Request FREE ESTIMATE